Looking for some regulated forex brokers for Scalping, intraday, or swing trading? There are lots and lots of forex brokers out there. Finding which one that suits you best is not easy. Don’t worry. You just came to the right place. We will help you find the most suitable forex brokers for you. In this article, we have a list of seven regulated forex brokers. We will give you a short overview of each broker to help you determine whether a certain broker is suitable for your trading needs. Before we get to the list, we will tell you factors to consider when choosing a broker first so you are better equipped to decide.

Choosing a Broker: Factors to Consider

When you are looking for a forex broker, you can’t just open an account on the first broker you see. Sure, you might get lucky. But that would be just too risky. What you should do instead is to take your time and put the following factors into consideration.

1. Security

The number one factor to consider when choosing regulated forex brokers is security. You can’t trade if the broker isn’t safe, let alone make profits. Remember that trading requires money and you are going to hand over your money to the broker. So, first and foremost, consider the security factor.

Thankfully, nowadays it is not difficult to check a forex broker’s credibility. There are plenty of regulatory agencies around the world who separate the fraudulent from the trustworthy. For example, the U.K. has FCA, Australia has ASIC, and so on. Be sure that your would-be broker is a member of renowned regulatory agencies.

2. Transaction costs

Regardless of whether you are a scalp trader, an intraday trader, or a swing trader, there will always be transaction costs as you trade. Each and every time a trader enters a trade, they will be subjected to pay either a commission or the spread. Naturally, you would want to find a forex broker who offers cheap and affordable rates.

The problem lies in the reliability. It is rare to find a reliable forex broker who offers the cheapest rates on the market. There has to be a sacrifice on the costs. So, choose a forex broker who is reliable and offers affordable rates for you.

3. Deposit and withdrawal

One of the easiest tells a forex broker is good is how it handles deposits and withdrawals. The more hassle-free the processes of both, the better the broker is. Keep in mind that a broker has no good reason to make it difficult for traders to withdraw profits. It holds funds only to facilitate trading. Nothing more. For example, EXNESS has instant withdrawal features. A good forex broker has an average time required to process a withdrawal of no more than 24 hours.

Before you hand over your money to a forex broker, make sure that the deposit and withdrawal process is hassle-free. A broker that makes it difficult is a red flag. If anything, a broker should make the withdrawal process easy, smooth, and speedy. Don’t settle for less.

4. Trading platform

Next is the trading platform. When you are engaging in online forex trading, your trading activity will mostly be done through the trading platform of the broker. For this reason, you want a trading platform that is stable and user-friendly. User-friendliness is especially important if you are a beginner trader as you are probably not familiar yet with trading.

What kinds of features that a trading platform should provide? Easy to understand and use charting and technical tools, a free news feed, and relevant information regarding trading, among others. When you are looking for regulated forex brokers, be sure to check out their trading platforms.

5. Trading Execution

Execution is really important as well. Under normal market circumstances, a good broker will fill a trader at the market price for each order. At the very least, the price should be very close to the market price or within the price’s micro-pips when a trader is clicking the “sell” or “buy” button.

Besides the price, the speed of the fill is also important. This is particularly true if you are a scalp trader. A scalp trader must win over half of their total trade to make up for the losses. And that would be very difficult if the fill is a few pips different.

6. Customer service

There are many excellent forex brokers out there but none of them is perfect. As such, it is not a matter of “if” but “when” a problem will arise. Knowing this, you should take customer service into consideration when you look for a forex broker.

How a broker handles technical support or account issues is very crucial. Perhaps it is crucial as to how it handles trades. A good broker will be capable of handling issues while being helpful and kind to the traders. Never settle for a broker that has bad customer service.

The List

Now that you know what factors should be considered in choosing a forex broker for your trading, let’s move on to the list. Below, we listed 7 regulated and safest forex brokers for scalping, intraday, and swing traders.

There are several great forex brokers for scalping and swing such as FUSION MARKETS, HOTFOREX, ICMARKETS, ROBOFOREX, VT MARKETS, TICKMILL, FBS, EXNESS, and many more that you can consider if you want to start forex trading business. Before doing it, you should know a little bit about those forex brokers. By learning about the forex broker, you know which one of them will be the best broker who will help you. The information below shows you about those brokers and hopefully, you can decide the best one after reading it.

1. IC MARKETS

This is an Australian broker. It has no trading restrictions and no requotes and thus, doesn’t have any price manipulation whatsoever. If you are a day trader who wants a true ECN environment for your trade, then IC Markets will be suitable for your trading needs. IC Markets has a very good review in the Forex Peace Army Forex forum.

• Regulation: ASIC

• Type: STP, ECN, Market Maker

• Minimum deposit: USD 200

• Forex leverage: 1:500

• Platforms: cTrader, cTraderiPad/iPhone, cTrader Android, cTrader Web, MT WebTrader, MT4, MT5, MT Android, MT Mac, MT iPad/iPhone, cTradercAlgo

• Other instruments: CFDs on commodities, indices, cryptocurrency, stocks, bonds, and futures

If you want to get more brokers in New York, so the answer is IC Markets. It is different compared to other forex brokers, IC Markets forex broker is known as a featured broker within 8MS. Faster and more stable than another forex broker.

2. FUSION MARKETS

Fusion Markets is a forex broker that offers low trading and non-trading fees, fast and easy account opening, and no minimum deposit required. The broker is regulated by the top-tier ASIC in Australia and has a clean track record with no major regulatory incidents or fines. The MT4 platform is the only platform available, which is a favorite with many forex traders but has an outdated design and UX. Fusion Markets does not provide investor protection, and popular assets such as real stocks and ETFs are not available. However, the broker has received the title of “best discount broker” in 2020, 2021, 2022, and 2023 from Brokerchooser.com. The product portfolio is largely limited to forex and some CFDs, and there are limited educational tools. Deposit and withdrawal options are easy and seamless for all clients. Overall, Fusion Markets is a great forex broker for those looking for low fees and fast account opening, but it may not be suitable for those looking for a wider range of products or investor protection.

Fusion Markets is a forex broker that offers low trading and non-trading fees, fast and easy account opening, and no minimum deposit required. The broker is regulated by the top-tier ASIC in Australia and has a clean track record with no major regulatory incidents or fines. The MT4 platform is the only platform available, which is a favorite with many forex traders but has an outdated design and UX. Fusion Markets does not provide investor protection, and popular assets such as real stocks and ETFs are not available. However, the broker has received the title of “best discount broker” in 2020, 2021, 2022, and 2023 from Brokerchooser.com. The product portfolio is largely limited to forex and some CFDs, and there are limited educational tools. Deposit and withdrawal options are easy and seamless for all clients. Overall, Fusion Markets is a great forex broker for those looking for low fees and fast account opening, but it may not be suitable for those looking for a wider range of products or investor protection.

Fusion Markets is regulated by the Australian Securities and Investment Commission (226199), Vanuatu Financial Services Commission (40256), and Financial Services Authority (SD096).

Copy Trading via Fusion+

Fusion+ allows you to copy other successful Fusion clients, have others copy your trades or simply copy between your own Fusion accounts, all within a few clicks.

Fusion Markets offers MT4, MT5, and cTrader platforms, and several deposit and withdrawal options. For depositing funds, clients can use bank transfers, credit/debit cards, and electronic wallets such as PayPal. There is no minimum deposit required, and Fusion Markets charges no fees for deposits. To withdraw funds, clients can use bank transfer, credit/debit card, PayPal, Skrill, Astro Pay, NETELLER, and other options. Fusion Markets charges no fees for withdrawals, and the process is usually executed within three days. Clients can only withdraw funds to accounts that are in their name. Fusion Markets does not charge any fees for deposits or withdrawals, and there is no minimum deposit required. There is a swap-free account option too.

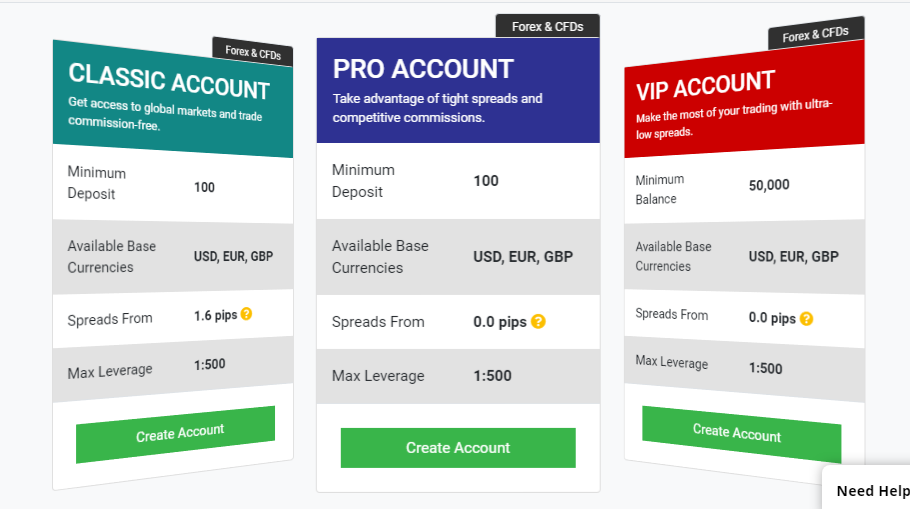

3. ROBOFOREX

This broker has grown quite well in the last few years. It is not surprising. Robofrex. After all, it has among the fastest executions in the forex industry. Not only that, but it also offers more than eight asset classes as well. Today, many traders are running micro accounts for their day trading activities, enjoying the tight spreads that the broker offers

• Regulations: CySEC, IFSC

• Type: STP, ECN, Market Maker

• Minimum deposit: USD 10

• Forex leverage:1:2000

• Platforms: R Trader (web platform), cTrader (desktop, Android, iOS, web), MT4 (desktop, Android, iOS, web), MT5 (desktop, Android, iOS, web)

• Other instruments: CFDs on soft commodities, indices, stocks, metals, energies, and ETFs. ROBOFOREX also has another instrument cryptocurrency as well.

Based on the experience of some traders, ROBOFOREX provides very fast withdrawal services in under 5 minutes. It is recommended to withdraw using USDT theter by creating a verified account first at GATE.IO the leading and most trusted crypto exchanger today.

4. TICKMILL Forex Broker Review

If regulated forex brokers are what you want, then Tickmill is undoubtedly among the best options with its five industry regulations. On top of that, the company has, not just little to no slippage, but also tight spreads as well, thus making it a very solid option for day traders alike.

• Regulations:

A. Seychelles Financial Services Authority (FSA)

Tickmill Ltd is regulated as a Securities Dealer by the Seychelles Financial Services Authority.

License number: SD008

FSA is established under the Financial Services Authority Act 2013. The regulator’s key responsibilities include the licensing, supervision and development of non-bank financial services in Seychelles through a solid regulatory regime.

B. Financial Conduct Authority (FCA)

Tickmill UK Ltd is authorized and regulated by the UK Financial Conduct Authority.

FCA Register Number: 717270

The FCA is an independent public body given statutory powers by the Financial Services and Markets Act 2000, regulating the conduct of both retail and wholesale financial services firms in the UK. The regulator’s mission is to make financial markets work well with the aim to protect consumers, enhance market integrity, and promote competition.

C. Cyprus Securities and Exchange Commission (CySEC)

Tickmill Europe Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission as a CIF limited company.

License number: 278/15

CySEC is the financial regulator of the Republic of Cyprus, established according to section 5 of the Securities and Exchange Commission (Establishment and Responsibilities) Law of 2001. The purpose of CySEC is to safeguard investor protection and facilitate the sound development of the securities market through the exercise of efficient supervision.

• Advantage trading with Tickmill:

• 0.0 SPREADS FROM

• 80+ TRADING INSTRUMENTS

• NO REQUOTES

• INDUSTRY AWARDED

• REGULATED BY THE FSA OF SEYCHELLES AND FCA OF THE UNITED KINGDOM

• Zero Commissions

• Minimum deposit: USD 100 for all account types

• Forex leverage: 1:500

• Platforms: MT4, MT5, (web platform), cTrader

• Other instruments: CFDs on shares, indices, futures, energies, metals, and also spread betting

Tickmill UK Ltd is authorized and regulated by the Financial Conduct Authority (FCA) and is required to segregate retail client funds from the company’s own funds.

As a member of the Financial Services Compensation Scheme (FSCS) in the UK, all clients of Tickmill UK Ltd are covered in the event of default by Tickmill UK Ltd. Clients are covered up to the value of £50,000.00.

Tickmill Ltd Seychelles is regulated as a Securities Dealer by the Financial Services Authority (FSA) of Seychelles. As such, our internal systems are in compliance with the FSA regulations, which means that your funds are held in segregated accounts to protect your assets.

5. JUSTFOREX ECN Broker Review

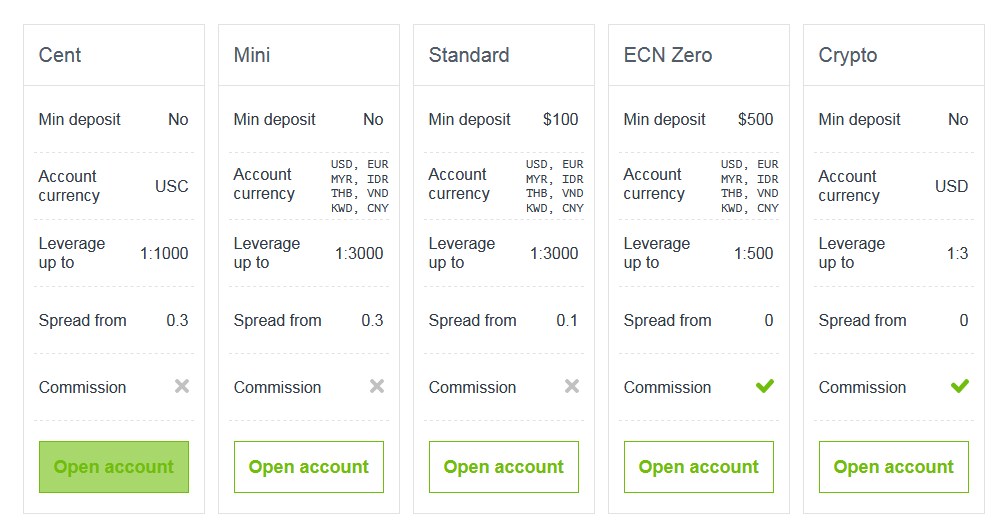

JustForex was founded in 2012 as a brand of IPCTrade Inc. JustForex is an ECN / STP forex broker. It is good for scalping and intraday trading.

For UK forex traders, you can ask for help from JustForex. The server of this reputable forex broker is located in London. What they offer to the forex traders is good connectivity. JustForex is a good choice if you want to find a featured broker within 3MS.

The company stood along with the most popular Forex brokers just in a couple of years due to the high quality of its services, the stability of work, and trading conditions based on the traders’ preferences.

JustForex offers a great choice of the most popular payment methods, a wide list of available financial instruments, tight spreads, completely no limits on trading strategies, and beneficial partner programs so we can get extra money.

JustForex is a retail Forex broker that offers great trading conditions on accounts such as Cent, Mini, Standard, ECN Zero, a wide choice of trading instruments, a leverage up to 1:3000, tight spreads, market news, and an economic calendar.

JF Global Limited, Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont, Kingstown, St.Vincent and the Grenadines, registration number 23993, registered by the Financial Service Authority (FSA).

JustForex has many types of forex accounts. See the details below for your preferences.

6. HOTFOREX Broker Review

Hotforex Is Better For Scalping And Swing Traders

Do you find difficulties starting to join a financial business like trading forex? When you decide to begin trading or scalping forex, you need to know what forex is and how to choose a company broker that provides facilities in trading/ scalping forex. Hotforex is one of the forex brokers that serves both retail and institutional clients. Most traders worldwide choose this broker because they get what they need including expert advisors. Besides that, this broker offers eight types of accounts, and all retail, affiliates and white labels can access interbank spread and liquidity.

Allowed All Trading Strategy Of Hotforex

The first thing is we have to complete our Hotforex account verification by uploading a scanned ID or passport and utility bill to the Hotforex support department as usual. Then if you have an account in this broker you access your account completely and you will get some benefits such as submitting documents online, checking account balance, transferring fund between accounts, monitoring trade history and trades in real time, getting advice from an expert advisor, using trading tools and you can access your last transaction as your reference.

The first strategy is information from Trading Central; a technical analysis report. This report presents information about financial research and assets in multiple languages. This information is really useful for both traders and scalpers to know what happened in the financial market in reality. The second strategy is the traders’ board which provides information on currency changes. This board is updated every 60 seconds, it helps clients to observe the market currency and consider it before making a financial decision. The third strategy is the economic calendar; it provides information about real-time economic situations for today, yesterday, tomorrow, this week, and next week. The fourth strategy is HotForex VPS Hosting which serves 24/5 a week. This service is available for both new and new clients with a $5000 deposit to maintain it for a month. Then, this hosting gives a powerful and protected connection for the client. Other advantages for clients are the facility to trade other assets (gold, silver, indices, oil, forex, commodities, and single stock), act with all expert advisors, free with any single deposit over $5000, facility execute trades 24/5 a week, easily reached from anywhere in the world, security with password accessibility, 20000 MB disk space, CPU up to 2200 MHz, 512MB RAM, Bandwidth unlimited, standard Forex VPS $30 per month, advance VPS $55 per month. The fifth strategy is a trading calculator that helps clients calculate financial deposits and gives information about what they can do with your assets. In addition, this calculator informs clients about where is their financial position, it is useful for them because they can execute the market after they know the real financial position. The sixth strategy is one-click trading; this facility helps you to execute by clicking a button. The seventh strategy is auto withdrawal; clients can transfer funds from accounts to their wallets. Those are facilities that Hotforex offers for its clients.

There are eight types of accounts; Micro account, Premium Account, Zero Spread Account, Cents Account, VIP account, Fix account, Auto account, and HF social account. Micro account has high leverage which is up to 1:1000. Lastly, there are some bonuses that this broker offers such as a forex rebate of up to USD2 per lot directly to your account with a minimum deposit of $100. This bonus is 100% supercharged, other bonuses are increasing leverage. Also, Hot Forex offers Forex Copy Trade for all new traders to get the first profits from professional traders on the Forex copy list provider. Those are hot forex broker facilities that you need to consider if you want to join this broker. Becoming a client or having an account at this broker is not difficult, you just need to apply and choose what account type you need. There are eight account types with features and you can choose one of them. Learn more about tight forex spread on hot forex to get maximum profit.

To get the fastest withdrawal experience, it is recommended to withdraw using USDT by creating a verified account first at GATE.IO the leading and most trusted crypto exchanger today.

HotForex has fast execution across a perplexing variety of six different account types. Despite a moderately enhanced MetaTrader offering, HotForex provides a wide selection of tradeable products compared to leading multi-asset brokers. HotForex is also an STP forex broker.

Founded in 2010, HotForex is regulated in one tier-1 jurisdiction and three tier-2 jurisdictions, making it a safe broker (average risk) for forex and CFDs trading.

HotForex is a MetaTrader broker that offers the full MetaTrader suite with an optional tools package for customers called Premium Trader Tools to enhance the default experience. Customers have access to just over 100 securities, and limitations apply; for example, crypto CFDs are not tradeable on weekends.

With six different account type options, pricing at HotForex varies greatly by account type. At best, HotForex’s pricing is better than the industry standard.

Lastly, if we want to get some extra cash from Hotforex affiliate partners, we can join and promote our affiliate links to by joining as a Hotforex rebate promotion or if you have some great Forex strategy test your best trading skill in Hotforex demo contest.

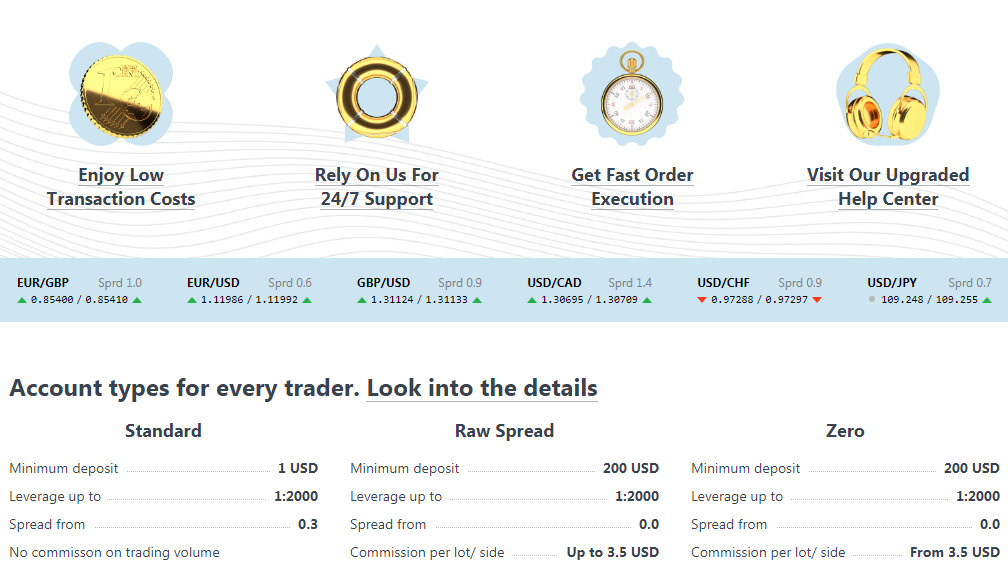

7. EXNESS Broker Review

Perfect For Scalping Traders

Do you have an interest in joining a forex broker for scalping forex? If you are interested in this field, you have to know first which broker you choose to get a good service. Exness as the best forex broker for scalping with 1:2000 leverage and candlestick basic patterns is a broker that gives its trader all facilities to get profit in scalping forex; with 1:2000 leverage, Exness provides the trader to have much-borrowed money in forex and with candlestick basic pattern, traders can access market instantly to get the actual information about what is happening in the market and it also helps you get a lot of pips.

Exness is a forex broker that has been founded in 2008. Exness gives full facilities for traders in scalping forex who have an account in its company. It has a deep comprehension in scalping forex and it supports traders to get what they need. All members of exness will realize their potential in this business field because they get it from exness.

WHAT TRADERS NEED IN THIS FIELD?

The first is the rule that gives traders profit. There are various instruments in trading, fixed spread, there is no commission for the company when traders collect their profit and save it. The second is reliability; the company gives surety to all traders that their infestations and profits are safe. The third is the service-based global standard; it makes traders comfortable when executing because they just need one to two seconds to do it. The fourth is transparency, the company shares information about how it works.

The fifth is quality, the company always considers all that traders want to get. The sixth is accessibility; since there is no commission for trading, everyone can access all services that the company provides. All those facilities that Exness provides are for traders’ pleasure and if you are interested in scalping forex, you can consider this company.

Other support for clients that Exness provides are official websites that can be accessed in 22 languages and the support in 13 languages includes 24/5 for 10 languages and 24/7 for three languages (Russian, English, and Mandarin). It means that not only in one or two countries clients of Exness. The second is leverage up to 1:2000. This facility helps clients manage trading strategy and eases them to deal with margin. 1:2000 margin is available for some accounts; cent account and mini account.

There are four kinds of accounts that you can choose. The first is the cent account; by choosing this account you have to deposit a minimum of $1 converted to the cent, a lot from 0,01=$0,1 cent/pip, 1:2000 leverage, spread from 0,7 pips, supporting automatic depositing and withdrawal of money such as NETELLER. The second is a Mini account, this kind of account has similar specifications to a cent account except for a deposit minimum of $10, and leverage up to 1:2000. The third is a classic account; the specification is a deposit minimum of $2000, leverage up to 1:2000, a lot from 0,1=$1/pip, spread from 0,3 pips and supporting Automatic depositing and withdrawal like other accounts above. The last is the ECN account; the deposit minimum for this account is $300, leverage up to 1:100, a lot from 0,1=$1/pip, spread from 0,1 pips, and supporting automatic depositing and withdrawal.

The EXNESS is already an established broker as it already won a global award. It offers amazing account types with security and safety of funds. The broker is also recognized as among the best in the forex industry in terms of trading execution. This is expected, considering how the broker tries to keep up with the latest technologies.

Nymstar Limited is a Securities Dealer registered in Seychelles with registration number 8423606-1 and authorized by the Financial Services Authority (FSA) with license number SD025. The registered office of Nymstar Limited is at F20, 1st floor, Eden Plaza, Eden Island, Seychelles. Nymstar Limited is duly authorized to operate under the Exness brand and trademarks.

The Easiest Deposits & Withdrawals In The Market

Fund your trading account via wire transfer, or credit card, or get your money immediately using our automated, instant withdrawal methods!

• Regulations: FSA, FSCA, CySEC

• Type: ECN

• Minimum deposit: USD 5, GBP 5, EUR 5,

• Forex leverage: 1:2000

• Platforms: (iOS, Android), MT4 (desktop, web platform, Android, iOS, Mac, multi-terminal), MT5

(desktop, web platform, Android, iOS, Mac)

• Other instruments: CFDs on indices, commodities, shares, and spot metals

Try trading with exness with instant withdrawal services. Open a live Forex account with Exness with leverage up to 1: 2000.

8. FBS FOREX

Something is interesting about this broker. FBS advertises itself as a broker that doesn’t charge swaps or commissions for certain accounts. This makes it an exciting option for day traders. Not to mention it also has no slippage promise and very tight spreads, making it all the more attractive.

FBS has been an international forex broker since 2009 and has more than 190 branch offices currently including in Indonesia. More than 14 million traders and 370 thousand partners have chosen FBS as their forex broker.

• Legal Documents: Domain all property rights of FBS Inc .; Registration No. 74825; Addresses at Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands MH96960

Website operated by FBS Markets Inc .; Registration No. 119717; FBS Markets Inc. is regulated by IFSC, with IFSC / 60/230 / TS / 18 license number; Address at: No.1 Orchid Garden Street, Belmopan, Belize, C.A.

• Minimum deposit: USD 5

• Forex leverage: 1:500

• Platforms: cTrader (desktop, iOS, Android), MT4 (desktop, iOS, Android, web platform), MT5 (desktop, iOS, Android, web platform)

• Other instruments: CFDs on commodities, indices, and cryptocurrency

This is a list of the best Forex robot hosting providers directly supported by EQUINIX

Hopefully, the list of reputable forex brokers around New York, London, and around the globe here helps you to get the best broker for forex trading activity so you can get significant income.