In this article, we will explain the strategy, why use it and its pros and cons. We will also explain its variants as well since there are many variants of it. Depending on your goals, you can employ the variants to be your 1 min forex scalping strategy, 5 min strategy, or whatever. Ready? Let’s get started.

Scalp Trading or Scalping, Explained

Alright, so what exactly is scalping? Scalping refers to doing lots of trades, each of which has the potential to produce profits. It is one of the day trading strategies and is the quickest of them all. Scalp traders put their focus on the number of their trades instead of the quality due to the short-lived nature of the strategy. It means forex scalping is a trading method that involves taking advantage of small price movements over a short period of time. In a Forex scalping strategy, traders open and close positions within seconds or minutes. The goal is to make profits quickly and efficiently. However, there are risks associated with scalping, such as the possibility of large losses in a short period of time if not done correctly.

The forex market is known to be the most volatile and liquid market as it changes very rapidly. This changing nature is what the scalp traders exploit. These traders take advantage of small changes that happen in the market. The traders tend to be done over a short period.

When other trade strategies put the focus on the quality of the trades, scalping does on the quantity. The profits come from high volumes of trades. In general, during the trading, a trader doesn’t expect to lose over 7 pips/trade, or get over 10 pips/trade.

The advantages of Forex scalping include the ability to make profits in a short time and increase returns on investment significantly. However, there are also risks associated with scalping, such as market risk, technology risk, and liquidity risk.

To get started with a Forex scalping strategy, you need to choose the right currency pair and time your entries and exits properly. You also need to understand simple and advanced scalping techniques and know how to manage risks effectively.

Why Scalping?

Now you get a picture of what scalping is. The next question that comes naturally is why should you choose it over the other strategy? If properly and timely executed, scalping can yield lots of profits continuously. This is especially true if the trader also takes recent trading analysis, economic events, and financial reports into account.

There is also the fact that scalping minimizes loses. Both the profits and losses are relatively small. What makes them large is the volume of the trades, which is entirely on the trader’s hand to decide. Because of this, a trader can better control both profits and loses of their traders.

Pros and Cons

There is no such thing as the perfect trading strategy that can work for everyone all the time and under any circumstances. It doesn’t exist. What do exist are strategies or techniques that work. And even this varies from one trader to another. The scalping strategy is not an exception. It too has pros and cons.

Pros

• Less risk exposure, which means you can avoid stumbling upon inauspicious events by having a brief exposure

• It can be applied most of the time, including even during quiet times a trader can scalp from smaller moves that occur

• Smaller moves, unlike larger ones, occur more frequently, which a trader can take advantage of to gain profits

• Small movements in the market are a lot easier to achieve

Cons

• To gain profits, you have to make lots of trades which translates to larger deposits

• The less duration of the trade, the more skills, reflexes, and good instinct are required. Aforex15 min scalping strategy will require less of these than 5 min strategy, for example

• Competition against dealers and bankers, both of which have superior information and knowledge of the market. This is particularly difficult for beginner scalper traders

• The shorter the scalping process is, the more time-consuming and stress-inducing it is

Is It for You?

Of course, only you know the exact answer to that. That being said, many things can help you get a perspective. First and foremost, the strategy requires not just making multiple orders but also constant analysis. This is quite time-consuming and very demanding one can even compare it to a full-time job.

Second, a trader must have the instinct to predict s the direction the market is moving to and does so quickly. Without this, a trader wouldn’t be able to optimize the strategy and make the best of the situations. Yes, being able to think on the fly is very important for the strategy.

If you have several hours available for trading, don’t mind the demand of the trading process like making multiple orders and analyzing, and able to think on the fly, then the strategy is suitable for you. Better yet, you might be able to make the best out of the profitable forex scalping strategy.

Variants

There are many variants of a profitable forex scalping strategy. Which one should you use? That is up to you, of course. To help you get a picture of the strategy, we listed three of them below. The variants are forex 15 min scalping strategy, 5 min strategy, and 1 min strategy.

#1: 15 Min Scalping Strategy

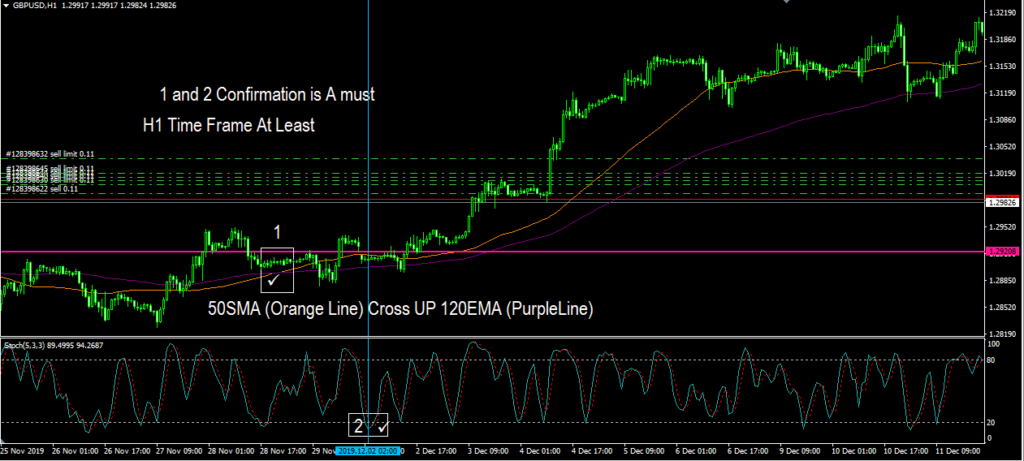

The first one is the 15 min strategy. This strategy uses three scalping forex indicators that works. Namely, Stochastic oscillator (parameters: %D 18.0, %K 26.0, and slowing 16.0), 50 SMA and 120 EMA. This strategy can be applied to any currency pair. If you are a beginner trader, trying the strategy on the demo account wouldn’t hurt, either.

When to buy

Before starting, you should limit the loss to 2 pips under the support level. Then, proceed to buy the currency pair when the conditions below are met:

• Primary condition where you should proceed to buy is when there is bullish pressure. You can see the pressure when the 50 SMA (the orange line) is crossing the 120 EMA (the purple line) and moving upward. Use one hour time frame or four hour time frame for reading current trend.

Then…

• When the fast-moving %K line (the blue line) crosses the slow-moving %D line (the red one) and moves upward from below the 20 level (the oversold region). The currency pair should break at this point and stay above the region, above the 20 level. You should proceed to buy once this condition is met. Use this overbought oversold stochastic strategy in smaller time frame in this case fifteen minutes chart for confirmation signal entry.

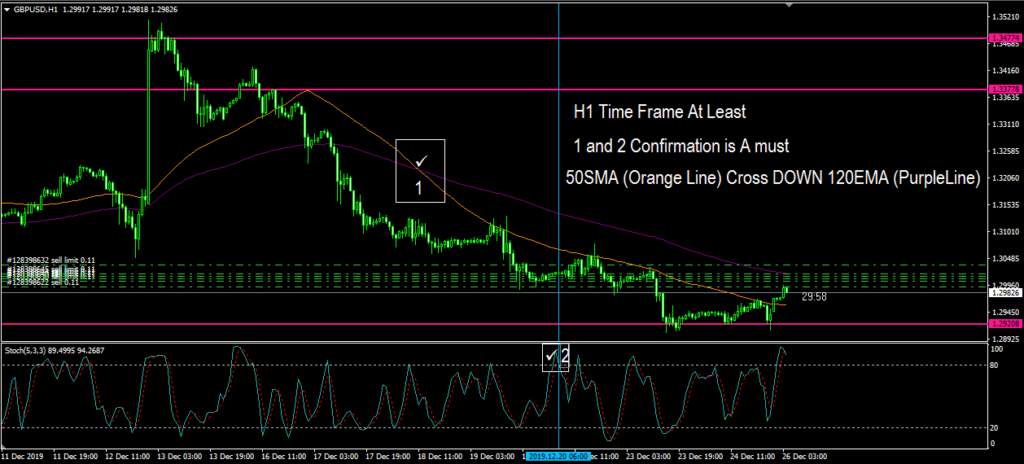

When to sell

You should proceed to sell if these conditions are met

• If the blue line crosses the red one and moves downward from the 80.00 level. The currency pair should break and stay below the level

• If the orange line goes across the purple one’s blue line and moves downward. This is evidence of the market’s selling pressure

When to exit

You should either take profit or exit when either of the situations below occurs

• The blue line crosses the red line. If the blue line is coming from inside of the oversold region, this indicates long trades exit signal. If the line is coming from the overbought region, this indicates short trades exit signal

• The orange line is crossing over the purple one. The orange line is moving bottom-up in a bearish trend or top-down in a bullish trend. At this point, the best thing you can do is to take profits and exit.

#2: 5 Min Scalping Strategy

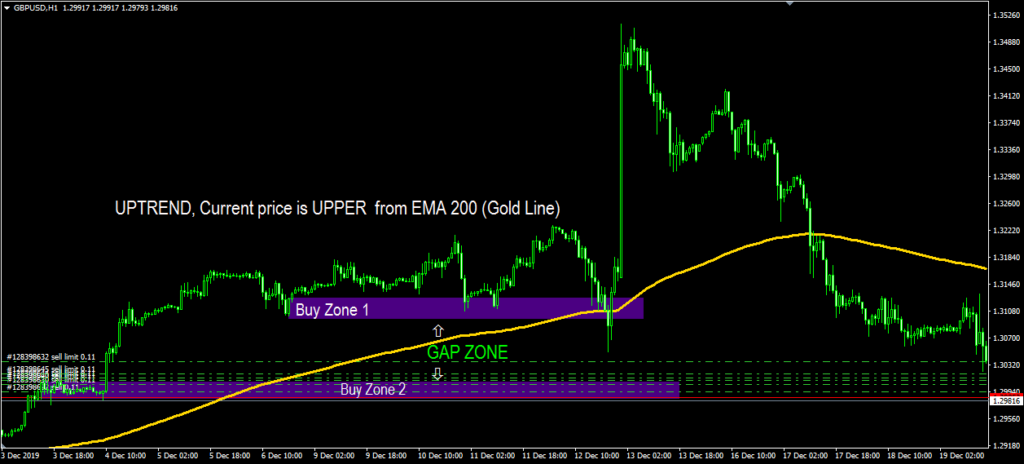

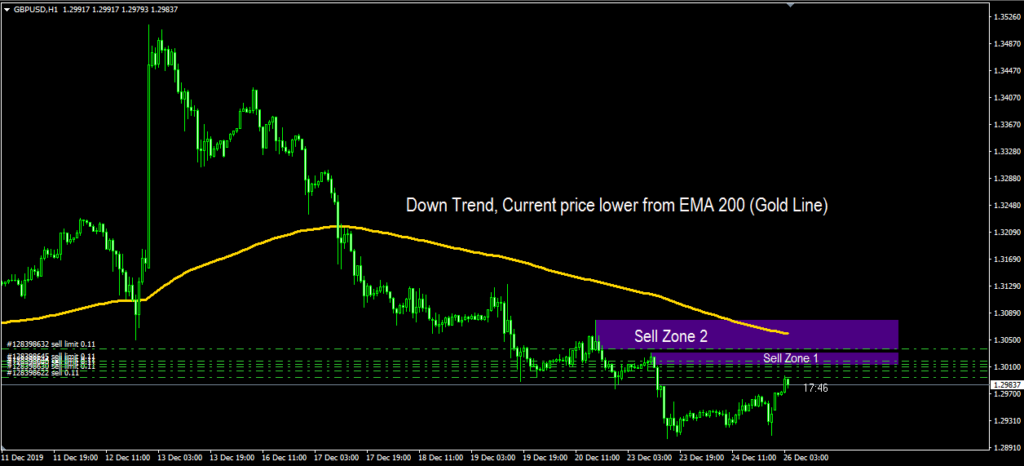

For this strategy, scalping forex indicators that works are a stochastic indicator and 200 EMA. The 200 EMA is utilized to search for the trend while the stochastic indicator tells you the situation of the market whether it is overbought or oversold.

Here’s how to use the 200 EMA to find the trend:

• If the price of the pair is above the EMA, it means there is an uptrend. This means you need to search for opportunities to buy

• If the price of the pair is below the EMA, it means there is a downtrend. This means you need to search for opportunities to sell

Buying setup

• The price must move above the EMA

• See the stochastic lines. See if the lines have moved downward below the 20 line and are currently moving upward

• Activate the buy market order

• Set the stop loss to around 15 to 20 pips

• Set the profit target to around 20 to 30 pips

Selling setup

• The price must move below the EMA

• See the stochastic lines. See if the lines have moved upward above the 80 line and are currently moving downward

• Activate the sell market order

• Set the stop loss to around 15 to 20 pips

• Set the profit target to around 20 to 30 pips

#3: 1 Min Scalping Strategy

The last one on the list is 1 minute forex scalping strategy. Here are the setups

• Stochastic oscillator (5, 3, 3)

• 50 EMA, 100 EMA

• Time frame (set to 1 minute)

• Take profit set to 8 to 12 pips

• Stop losses set to 2 or 3 pips

Buying

• The 50 EMA should be placed above the 100 EMA

• Wait until the price moves closer to the two EMAs

• The stochastic should be utilized to moves from below then crosses over the 20 level

• When these items are in place, proceed to buy

Selling

• The 50 EMA should be placed above the 100 EMA

• Wait until the price moves closer to the two EMAs

• The stochastic should be utilized to moves from above then crosses over the 80 level

• When these items are in place, proceed to sell. This is the 1 minute forex scalping strategy.

Best strategy how to identify buy and sell zone is using forex reversal candlesticks patterns to get fastest way to profit using scalping forex strategy.

High Probability Scalping Strategy

Here just another Best ICT forex strategy that works every time. Learn this video recommendation below. We can use this strategy as intraday, scalping on 5 or 15 minutes time frame or even swing strategy too.